IVA

An Individual Voluntary Arrangement (IVA) is a formal debt resolution established between you and your creditors, designed for situations where you're unable to afford your debts. It enables you to repay your debts through manageable monthly installments over a predefined period, typically around 60 months. This legally binding agreement provides protection from creditors and may facilitate the write-off of some unmanageable debt. Upon successful completion of your IVA, any outstanding balances within the arrangement are typically forgiven. The specifics of debt reduction in an IVA are tailored to your unique circumstances, contingent upon factors such as your total debt, affordability, and creditor agreement.

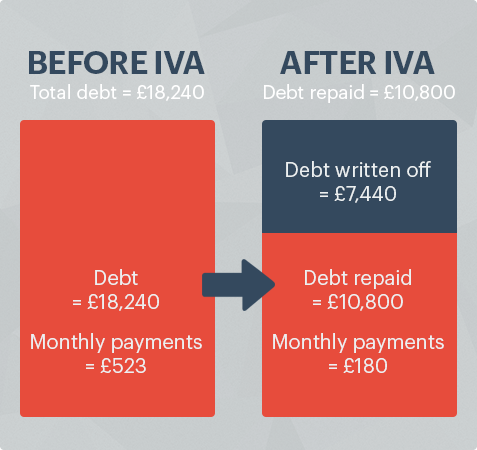

Here's an example of how an Individual Voluntary Arrangement (IVA) works

In the following scenario, the individual reached out to us, expressing their inability to sustain the contractual payments of £523 per month towards debts amounting to £18,240. Upon assessing the suitability of an IVA, we presented their proposal to creditors, indicating their capability to contribute £180 per month towards the IVA. The creditors accepted the IVA proposal. Over the course of 60 monthly payments into the IVA, our client will have repaid £10,800 to their creditors. Upon completion, the remaining balance of £7,440 will be legally discharged.

| Unsecured Debts | |

|---|---|

| Credit Card | £4,842 |

| Credit Card | £2,687 |

| Credit Card | £3,241 |

| Loan | £5,125 |

| Payday Loan | £902 |

| Payday Loan | £643 |

| Overdraft | £800 |

| Total Debt | £18,240 |

Commencing an IVA with our assistance

An IVA may be appropriate for individuals with debts totaling approximately £8,000 or more owed to two or more creditors, and who can commit to paying at least £90 per month towards the arrangement. To determine if an IVA suits your circumstances, one of our advisors will reach out to you via telephone to discuss your situation and offer guidance on managing your debt. We will request information regarding your income, expenses, total debts, and any other pertinent details to provide tailored advice. Subsequently, you'll have the opportunity to decide how you wish to address your debt.

If you opt to pursue an IVA, you'll need the expertise of a licensed professional known as an Insolvency Practitioner (IP). An IP possesses the legal qualifications to prepare, negotiate, and manage an arrangement on your behalf.

The Insolvency Practitioner (IP) will draft your IVA proposal document and distribute it to creditors for their review. Creditors will then vote on your proposal, facilitating negotiations between us and your creditors. Typically, an IVA can be established within 4 weeks from your initial contact with Quick Debt Fix. Upon approval of the IVA, you are legally safeguarded from your creditors, allowing you to commence your agreed monthly payments into the arrangement.

If you'd like to learn more about an IVA, please give us a call at 0799 955 9004, and one of our advisors will gladly assist you.

Advantages of an IVA

- Monthly payments based on what you can afford

- No upfront Fees

- Legal protection from creditors

- Interest and charges frozen on approval of your IVA

- We can set up an IVA in as little as 4 weeks

- Suitable for tenants or homeowners, individuals or couples, and even business owners

Disadvantages of an IVA

- Your credit rating may be affected for up to 6 years

- Your details will be recorded on the insolvency register

- If your IVA fails, your creditors may request that you be made bankrupt.

- If you are a homeowner with equity in your property you may be required to introduce part of your share of this equity in the final year of the arrangement. If you can't get a remortgage, your arrangement can be extended for up to another year.

FAQ's- Individual Voluntary Arrangement (IVA)

Below are a few of the frequently asked questions we are asked in relation to our IVAs. If you have any questions please feel free to get in touch and we will find the answers you need.

An IVA is an agreement to repay your debt at a level suitable for you and agreeable to your creditors. Each IVA is unique and tailored to your indivdual situation and has no 'set' criteria. To determine if you are eligible to propose an IVA, contact us.

- Loans

- Overdrafts

- Credit Cards

- Utility Arrears

- Council Tax Arrears and current year

- Catalogues

- Store Cards

- Payday loans

- Debts to family and friends

- Debts for professional services, i.e. solicitors, accountants, vets etc

- Some debts owing to HMRC for tax and national insurance arrears or tax credits overpayments

There are a few different types of IVA which can be proposed depending on your circumstances. Each of these IVAs have been outlined below.

Single IVA

A single IVA is a proposal solely in your name. It covers any debts in your name and any joint debts that you may have. The terms of the IVA will be dependent on your circumstances and the monthly payment will be based on your individual income and expenditure.

Interlocking IVA

An interlocking IVA is when two individuals propose separate IVAs that are mutually dependent on each other. When the IVAs are accepted they become interlocking and all creditors for both parties are paid from one joint monthly payment.

Lump Sum IVA

A Lump Sum IVA is usually a shorter term IVA with creditors receiving payment via a "one off" lump sum which may be money from a remortgage or family member for example. The duration of an IVA such as this can be as little as 12 months.

Assisted Payment IVA

This is usually a single IVA where you can receive assistance towards the monthly payment from their partner or spouse. As with a single IVA, it covers any debts in your name and any joint debts that you might have.

Self Employed / Sole Trader IVA

If you are self employed or operate as a sole trader then you can propose an IVA that will deal with both your personal and business debt, including any debts that you may owe to HMRC. This type of IVA could help your busines continue trading.

When you propose an IVA, your creditors are sent a proposal document to consider. They are invited to vote on this proposal at the "Creditors Meeting" to confirm if they are willing to accept your offer of repayment. At this meeting, if more than 75% (by debt value) of the total creditors who lodge a vote, choose to accept your propsal, then the IVA is approved and becomes legally binding on all creditors in the arrangement, including those that did not lodge a vote.

From time to time, some creditors may put forward modifications for you to agree to, before accepting your proposal.

Apply for an IVA

If you would like to discuss your options and find out if an IVA is suitable for you, then click here to fill in the IVA Application form. One of our advisors will be happy to chat with you and guide you in dealing with your debt.